I prefer to purchase from designers who have a passion for their craft first and foremost. Corporate world hard-nosed types won't get my help financing a sales quota motivational stunt.

What I Learned at the First Ever McIntosh Group Convention

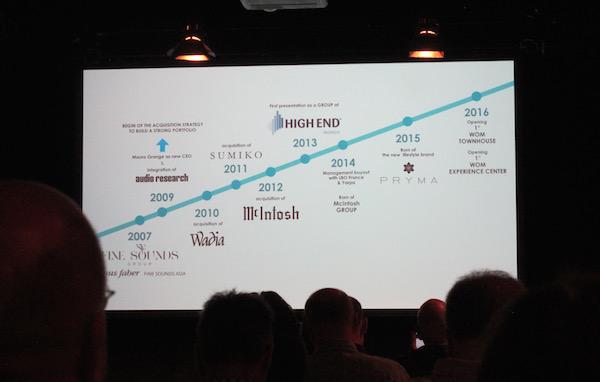

Among the attendees were distributors and dealers of the group’s brands McIntosh, Audio Research, Sonus Faber, Pryma, Wadia and Sumiko, as well as those brands’ executives, product designers and sales managers.

This was the first time all of the pieces of the puzzle that is the McIntosh group were assembled in one place. It was an opportunity for Mr. Grange’s to find out if all of the pieces fit together.

Also invited were audio journalists representing both print magazines and websites. There were enough people to fill the resort’s large auditorium.

The inclusion of journalists was interesting because really, there were but a few new products introduced, some of which have already been reported on, on this website. So why go to the considerable expense and trouble to invite us?

I figured we were invited to see how the new entity, which I think is known as McIntosh Group operated. I had thought the group was called WOM (World of McIntosh) but at this event it was called “McIntosh Group”. That would mean that WOM refers to the name of the “experience centers” being set up at dealers around the world and is also the name of the multi-story, multi-use New York City townhouse.

Most guests arrived Monday early and so had the day to decompress at the luxurious Forte Village resort on the Sardinian coast. Dinner that first evening was an opportunity for veterans like me to catch up with old friends in both the industry and the press (it was also an opportunity to avoid a few odious members of the press I proudly consider not friends.)

Tuesday was product launch day, which was handled much as you’d see it at Apple, or at a major automobile product launch, but rarely in the audio industry.

There were videos, glitzy lighting, loud music cues and a level of excitement and carefully constructed anticipation not previously seen in this business.

However, beneath the carefully constructed camaraderie, was the fascinating dynamic and somewhat uneasy relationship to be seen and felt between the McIntosh Group’s two iconic vacuum tube-based companies McIntosh and Audio Research. The group’s name alone plus McIntosh President Charlie Randall being the McIntosh Group’s COO, puts Audio Research in somewhat of a defensive crouch.

However, as this event made clear, the group understands both the similarities and differences between the two companies. I was asked for permission to use in the presentation part of The Audio Research video posted both on the Analogplanet website and on its YouTube channel.

Of course I gave permission. Interestingly, the only clip used was of the group’s Chief of Industrial Design, Livio Cucuzza, in ARC’s “museum”. Mr. Cucuzza’s re-imaging of the Audio Research “look” has been well received by long-term Audio Research fans.

No footage was used showing manufacturing at Audio Research. However, Audio Research’s Director of engineering Ward Fiebiger—a thirty five year plus veteran of the company— had a chance to speak to the crowd.

More importantly for Audio Research is that after a few years of having no new products, the company has recently launched the well-received upper-mid line Ref 6 and Phono Ref 3 and at this event showed an attractive new line of $7500-ish products. There were rumors of yet another new even less expensive line next year. So clearly McIntosh Group continues to invest in, and believes in a great future for Audio Research.

“Lifestyle” products are clearly important to the group. In addition to the introduction of the Sf16 (already covered by analogplanet), a great deal of presentation time was devoted to the new Pryma headphones—not for their sonic performance, but for their looks and for how the group is promoting and selling them.

This was the most fascinating part of the presentation because it laid bare the shallowness and lameness of 21st Century identification-based marketing at its best/worst. These gorgeous looking headphones are being marketed based on group identification, much as Beats headphones have been. Given their huge success based on nothing other than the celebrity behind the name, who can blame the McIntosh Group for going there?

From getting Beyoncé to wear a set in a video seen a million times to selling the Pryma headphones at Barney’s and other non-traditional (for audio) retailers, McIntosh Group is going with gusto for the mainstream/luxury marketplace with an intense focus not even B&O has mustered over the past few decades. Smart marketing minds have been brought in to produce sales results not usually seen in the high performance audio sector.

Though both the Sumiko and Wadia logos were on the group’s promotional material and on the presentation screen, neither were mentioned so how those pieces fit into the McIntosh Group puzzle remains to be seen.

For those who worry that the McIntosh Group’s fixation will be style versus substance, considering that Sonus Faber will introduce a new, ambitious top-of-the line “Homage” series of speakers and that at Axpona this past Spring, I and other reviewers thought the best sound at the show was produced by Sonus Faber’s $46,000 Il Cremonese speakers driven by new Audio Research electronics (Ref 6 preamp, Ref 3 Phono, and GS150 stereo amplifier), those worries seem unfounded.

So I think what we’re seeing from McIntosh Group is a push for performance excellence where appropriate (McIntosh, Sonus Faber, Audio Research), and “lifestyle” excellence where appropriate (Sonus Faber Sf16 and Pryma headphones). Is there any reason to complain about this?

As I speculated in one of my original posts, this expensive event and the previous one at Sonus Faber’s Vicenza, Italy headquarters where it launched (and ended) the $30,000 Extrema loudspeaker, were smartly financed by the products themselves.

At the Vicenza event, to celebrate Sonus Faber’s 30th anniversary, after it was announced that the speaker was a limited to thirty pairs edition, dealers and distributors in attendance promptly snapped up the entire run. Do the math: 30 times say $12,000 (wholesale price) equals $360,000. So most likely all of most of the event was paid for before attendees got on the plane to return home!

Likewise, this even more expensive event introduced the snazzy Sf16, limited to two hundred units a year. After the carefully and expertly handled roll-out came a frenzied response from dealers and distributors. I have no doubt most if not all of the first run of two hundred were sold if not then and there, then before the end of the four day event. Again do the math: two hundred units times an approximate wholesale price of $4500. That’s $900,000. Probably enough to throw and pay for a gala, luxurious event that also included a day four sales meeting with distributors and dealers to which journalists were not invited.

My sources told me it was a hard-nosed, though often celebratory affair where those who exceeded goals were handed bonus cash and those who didn’t were “squeezed” to make up the difference in the next quarter between goals and results. There’s nothing unusual in this—at least in the big corporate world. Very unusual in the high performance audio world!

Finally, in a moment of extreme candor at lunch on the event’s final day, Mr. Grange related to the people at the table at which I sat, one of his previous job experiences where, in order to meet a very large, sales obligation, he hired at great expense a large ship and invited onboard a large contingent of individuals he needed to produce seemingly impossible results.

Grange concluded by saying his gambit succeeded and he met and surpassed his quota. Clearly, so far he’s brought his “A game” to McIntosh Group and in the future expects to achieve similar results.

- Log in or register to post comments

... wonder how many customers (long ago) were influenced to buy AR speakers because they put a photo of Arthur Fiedler in their literature?

Considering the first thing they did when they bought Wadia was to kill the 24/192 S7i upgrade and the lack of any new reference product it appears they are content to let Wadia simply fade away.

I was expecting to at least see the Digimaster algorithm as an option in the ARC CD 9, but no.

I have no idea what you mean to represent by "wholesale price" from this article.

I normally take "wholesale cost" in most retail markets to mean what a reseller could buy the item for; i.e. what in the audio industry we call "dealer cost" (which doesn't include such things as borrowing cost, if any, and shipping to the retail outlet).

$12K pertaining to a $30K retail product is ... what ... exactly? Not dealer cost, surely ... That's a 60% margin or put another way, a 250% markup. Unless the business has changed drastically since I was part of it.

Manufacturer's cost of production (ex shipping, R&D, marketing, etc)? Or?

Johnny2Bad what?

12K is exactly what a distributor is buying a 30K product for. He then sells it on to a dealer who is usually working on a 30- 50% Profit margin. The rest covers his cost for logistics, storage,employees wages and the Money you need to put food on the table.

In my experience distributors would take a 10~15% margin (18% markup). You are saying the modern distributor is earning the same margin the reseller earns? I'm in the wrong business.

The dealer margin you cite sounds more like it, although again in my experience the more expensive the item, the lower the margin. 50% is for house-branded speakers, various accessories under $100 retail, etc. 30~35% for components.

You might get a shipping allowance if you are ordering in quantity, but usually the dealer is paying for shipping on top of his invoice cost.

Dont know if us Manufacturers have a different deal with US distributors but the figure I quoted is correct for pretty much all of europe. If I buy sub 500% Items the profit margin for the dealer is actually less over hear but the qunatity sold will be higher. On a product like the ex3ma the distributor will be making about 3 K on it. even if it was not limited edition. You dont sell more than 2 or 3 per year if you are lucky. So based on that you would not be interested if you where earning less than that.

That was meant to read sub 500$ Items

Okay, you are referring to sub 500$ components, like, say, a receiver. Would not the MSRP be in the 35% margin range, and the dealer selling for a smaller margin (say 25%)? That would make sense for a bricks-and-mortar store.

But what about smartphone cables? Don't the resellers make more than 35% on such an item in the EU as they would in the US?

But computer accessorys you will be very lucky to make 30% on. mostly less, but you dont need to, remeber you are talking different quantitys here. Not comparable to 30K speakers.

I don't really understand your last post. What is a "sub 500% item" ?

And if the cost to the distributor is $12K and the dealer has a 35% margin that leaves 8K for the distributor. That's a 60+ % margin for the distributor.

What is the $3K figure for? Are you suggesting dealer cost is $15K and a 50% margin is normal in the EU for resellers?

Again, I'm in the wrong business, or perhaps wrong location for the same business.

Yes the dealer cost for a sonus faber speaker worth 30K retail is about 15K. Are you sure you are in the wrong business? How many 30K speaker would you expect to sell in a european country per year? one or two, maybe Three in a very good year. What is your Overhead and other running cost? I could go on, but the point is if you are in Hifi to get rich, you either live in asia and have a very loyal customer base or you are in the wrong business.

... and we didn't make 50% margin on anything beyond accessories, we paid early and got the early payment discount and usually had shipping allowance due to the volume we sold. We sold everything at our cost (actual cost; ie with any discounts or extras figured in, not the book price) times a 33% margin and earned 10% net profits each year (8~11% over 10 years).

So a $15K speaker we would sell (assuming all costs were built into the $15K cost) at $19,950 retail

Sorry, it's been a while since I fielded a calculator, that should be $22,500

Please don't ever refer to Audio Research Corporation products as "Audio electronics" ever again.

" ...

Cremonese speakers driven by new Audio electronics (Ref 6 preamp, Ref 3 Phono, and GS150 stereo amplifier,

..."

It was a simple request. I said "please", and I didn't use uppercase. Trust me, you will know when I'm not calm ;-)

For three generations we bought Macintosh products in my family. Since this consolidation the legendary service has evaporated. Gone. Macintosh has become, at best, a consumer durable. Since selling off several reasonably new Macintosh pieces, I've been so impressed with the replacements that my consumer loyalty was terribly misplaced. Good luck to them.

Purists will take offense, but I believe there is room in the HE world for "lifestyle" marketing. Consider for a moment all of the bling that is sold because ownership can be displayed by the owner ? Sure many of the owners are poseurs, but their purchase dollars make real money for the company, and ensure that the company can continue to produce products for true enthusiasts. HE audio should be no different. Lifestyle, if successfully implemented across the HE industry can be very successful in raising the profile of the entire industry.

Considering the Mcintosh group, I see similarities to the ownership of Marantz. Many of the Marantz branded products are mirrored in the products of other family brands, most notably Denon. Yet Marantz remains distinct, with premium products, at mostly higher price points. Looking at the Mac family I see where each member can provide expertise in a specific area across the brand, while still maintaining a distinct identity. Going forward I would not be surprised to learn that future Audio Research and Mcintosh products will contain similar circuits and features. However each will have a distinct sonic and aesthetic identity. Mac will lean towards the lifestyle end, while AR will remain for the purist.